- Published on

Can APIs Unlock Africa's Earth Observation Market?

Rethinking the Role of Policy

In one part of my earlier three-part series, I argued that stronger policy and government buy-in might be the stepping stone to building a sustainable Earth Observation (EO) market in Africa. After more conversations, reframing the context, and digging into research, I am less convinced.

Policy can help, but policy alone is a fragile bet. It assumes coordination across stakeholders (local, national, and regional) with different political priorities and economic realities and most critically, places development at the mercy of the slowest-moving factor. My earlier take was that public demand would pull the commercial sector along. In Africa, that path looks slower than a market-driven alternative.

What I now see more clearly is that market-driven networks are more resilient. They work around fragmentation instead of waiting for governments to cooperate which shifts the bottleneck from “we need better policy” to “we need smarter market models that don’t collapse under political complexity.”

A market-driven network is a system that puts a useful capability in people’s hands so they can pull themselves in. Every new user can plug in, get value immediately, and by doing so makes the network more valuable for the next person. The market grows because people can pull the technology into what they already do. This fits the idea of market-creating innovation described in The Prosperity Paradox. In this framing, market-creating innovations lower complexity of products by making them accessible to a broader population. EO has rarely been packaged this way. it is very highly technical and locked into specialists workflow. But if EO’s value is packaged so non-specialists can access it, maybe then we can have a bigger market.

How do we then put this in everyone’s hands and which models can we look to or learn from?

Lessons from Fintech

The fintech growth in Africa clearly shows this dynamic. Fintech startups in Africa attracted over 960 million U.S. dollars in investment as of 2023 Nairametrics, and one report estimated that African fintech revenue could quintuple by 2025 to reach $230 billion.

Traditional banking systems in Africa faced several structural problems that limited payment processing but one major approach have been instrumental in how African fintech companies like Paystack and Flutterwave have addressed critical banking infrastructure challenges across the continent.

When Paystack launched in 2015, they made the API gateway model truly accessible to the African market, allowing developers and businesses to connect seamlessly to payment infrastructure without the high costs and complexity that had been barriers. Flutterwave followed in 2016 with a similar model but broader continental ambitions from the start. They dramatically expanded the addressable market by making financial services accessible to thousands of businesses that previously couldn't afford the complexity of traditional banking integration. They adapted the successful approach that companies like Stripe had established globally.

Paystack raised about 9.3 million dollars before being acquired by Stripe for over 200 million in 2020, one of the biggest exit by an African startup. Flutterwave has raised just over 475 million dollars to date (including a 250 million dollars Series D in 2022) and now processes over $200 billion in transactions annually across 34 countries.

This model won't magically turn EO into fintech-scale markets. But reducing friction between valuable services and potential users applies regardless of market size. Even a small success in making EO more accessible could have outsized impact.

Emerging EO Model

A similar pattern is now emerging in EO. Amini, a Nairobi-based company, uses AI to process satellite and ground data into actionable insights delivered through simple APIs. By abstracting away technical complexity, they have created user markets and attracted significant investment. In 2023, they raised 2 million dollars in pre-seed funding, followed by $4 million in seed funding.

Amini's $6 million in private venture funding appears to be quite significant in the African geospatial startup space and proves that the right model can attract serious capital.

Conversations with developers in Africa also confirms this trend. Developers are building API services that deliver EO insights to local businesses, although at a lower scale, which points to real organic demand for simple access to EO data.

Accelerating this with AI

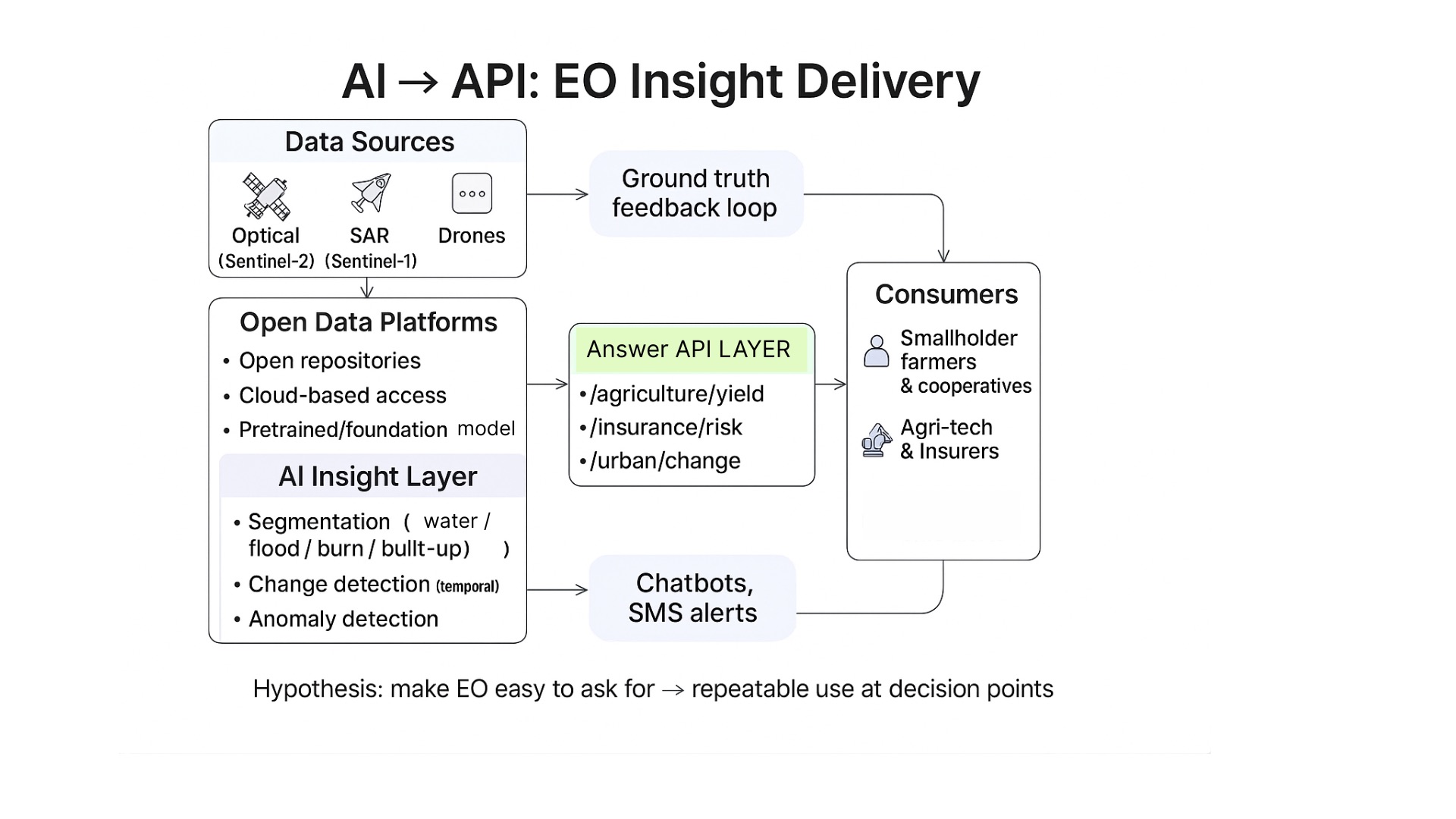

AI can accelerate this. It can serve as the engine that turns EO into answers people can actually use and does it at a scale that was impossible just a few years ago. Data are fed into AI models that automatically handle the complex processing. These models pull data from existing open data platforms which provides access to massive satellite archives. With the rise of foundation models, businesses in Africa will not need to train models from scratch. There a lot of pre-trained models that already understand satellite imagery and can be fine-tuned for local context.

This architecture fundamentally shifts the economics of EO services. The value creation happens in the AI layer that interprets this data and the API layer that makes those interpretations accessible to businesses. Google.org's new 25M dollars investment in the AI for Food Security is a strong proof of this opportunity, funding African researchers and nonprofits to build AI tools that forecast hunger, improve crop resilience, and give farmers real-time insights for better decisions.

This will also not happen automatically. We still need to build the infrastructures that makes AI-powered intelligence easy to access.

Addendum

Additional information after the initial publication.

Since completing this draft, I shared it with a few close friends. One question that stood out to me was: “How do you put EO in the hands of the average person?” I came up with two answers:

- Chatbots: Globally, people have been experimenting with chatbots for agriculture usually reyling on surveys or weather APIs. In Botswana, AskMolemi is testing a new approach, using EO data to deliver personalized agriuctural advise to farmers via Whatsapp. Although still an MVP, this show how EO insights can be made accessible in everyday conversation.

- SMS alerts: Even basic phones can receive simple warnings, like drought risk or flood alerts, powered by EO data.